Are you thinking about investing in leasehold properties in Bali? Bali’s stunning scenery, rich cultural heritage, and affordable property prices have caught the interest of international investors looking for lucrative opportunities.

Our objective with this article is to explore the vibrant market of leasehold properties in Bali and provide you with invaluable investment advice to help you fully leverage this promising opportunity. Whether you are an experienced investor or a first-time buyer, these insights will help you make informed investment decisions. Let us commence our exploration.

Introduction to Bali’s Leasehold Market

Leasehold properties in Bali have become a favored choice for many investors seeking lucrative opportunities. However, it is crucial to comprehend the intricacies of land ownership in Indonesia before venturing into leasehold investments. Here are some key considerations:

- Advantages of leasehold properties in Bali: High Returns on Investment: Leasehold properties offer the potential for significant financial gains.

- Favorable Short-Term Rentals: Leasehold contracts typically experience a gradual decrease in value over time, which can be advantageous for short-term rental arrangements.

Limitations of leasehold properties in Bali:

- Predictable Limitations: Leasehold properties tend to depreciate over time, and this limitations can be expected.

- Diminishing Value: As the leasehold contract has a limited duration, the investor may extract less value as time progresses.

It is important to note that Bali still has numerous lands held by their owners under “girik” land, which are inherited or custom lands owned by Indonesian citizens. Despite the global outlook, the Indonesian market remains attractive to foreign investors.

Foreign investors often misconstrue the concept of leasehold in Indonesia, as it differs from that of common law countries. Therefore, thorough research and seeking professional advice are strongly recommended before making any decisions regarding investing in leasehold properties in Bali.

Understanding Leasehold Properties

Leasehold properties in Bali provide an exceptional real estate opportunity, where the lessee and the landlord establish an agreement for renting the property over a specific period, usually lasting between 20 to 50 years, with the option to extend if desired. During this lease term, the investor enjoys exclusive rights to utilize and occupy the property for their intended purpose, as mutually agreed upon. Acquiring a leasehold property involves a straightforward process, with the lessee’s or foreigner’s name prominently featured on the lease agreement.

It’s important to note, however, that the formal lease documents are not registered with the Indonesian Land Registry.In comparison to freehold properties, leasehold properties generally offer a more affordable option. It is crucial to understand that leaseholders do not possess ownership rights over the property or the underlying land.

At the conclusion of the lease term, the property reverts back to the original owner unless the leasehold is renewed. In the event of non-extension, all rights revert to the original owner, resulting in the property transitioning into a freehold Hak Milik property.Foreigners have the opportunity to purchase properties in Bali and other parts of Indonesia under various ownership structures, including Hak Pakai (Right to Use) and Hak Sewa (Leasehold) for residential properties, as well as Hak Guna Bangunan (Right to Build) for commercial purposes.

On the other hand, Indonesian citizens enjoy the flexibility to utilize any of the four ownership structures, which encompass Hak Milik or Freehold, Hak Pakai or Right to Use, Hak Guna Bangunan (HGB) or Right to Build, and Hak Sewa or Leasehold.As a foreign property investor, your choice between leasehold and freehold properties in Bali should be driven by your specific requirements. Despite the necessity of involving an Indonesian entity (nominee) as a titleholder for the land certificate, freehold properties on Bali Island continue to be highly sought after and frequently sought by foreigners. Rest assured, you can make an informed decision that aligns with your investment goals.

Advantages of Investing in Bali’s Leasehold Properties

Investing in leasehold properties in Bali offers several advantages, although it’s important to consider potential drawbacks before making a decision. Here are the key points to consider:

Advantages of Investing in Bali’s Leasehold Properties:

- Lower Upfront Costs: Leasehold properties often have lower initial costs compared to freehold properties, making them more accessible for investors.

- Reduced Maintenance Responsibilities: With leasehold properties, the landlord typically bears the responsibility for maintenance costs, relieving investors of this burden.

- Easier Exit Strategy: Terminating a leasehold agreement is generally easier than dealing with a freehold property, providing investors with more flexibility in their investment plans.

- No PMA Requirement: Acquiring a leasehold title doesn’t necessitate establishing a PMA (Penanaman Modal Asing), simplifying the investment process.

Other Considerations:

- Flexibility: Leasehold contracts can offer flexibility in terms of selling the lease or renting the property for short-term stays, providing additional income opportunities.

- Limited Time Frame: Leasehold contracts typically span 25-30 years, limiting the long-term value extraction potential for investors.

- Limitations: Leasehold properties may experience limitation over time, affecting their overall value.

- Restrictions: Some leasehold properties might have restrictions on certain activities, such as running a business from the property.

It’s crucial for investors to weigh these pros and cons carefully. Seeking guidance from a real estate professional familiar with the local market and regulations can prove beneficial.

Legal Considerations for Foreign Buyers

Before diving into Bali’s leasehold market, it’s crucial to familiarize yourself with the legal aspects. Here are a few key considerations:

- Seek Professional Advice: Engage the services of a reputable legal professional experienced in dealing with foreign investments in Bali. They will guide you through the legal requirements and ensure compliance with local regulations.

- Leasehold Agreement: Thoroughly review the leasehold agreement to understand the terms and conditions, including the lease duration, renewal options, and any restrictions on property usage.

Researching Potential Investment Locations

When it comes to investing in leasehold properties, location plays a vital role in determining your investment’s success. Consider the following factors:

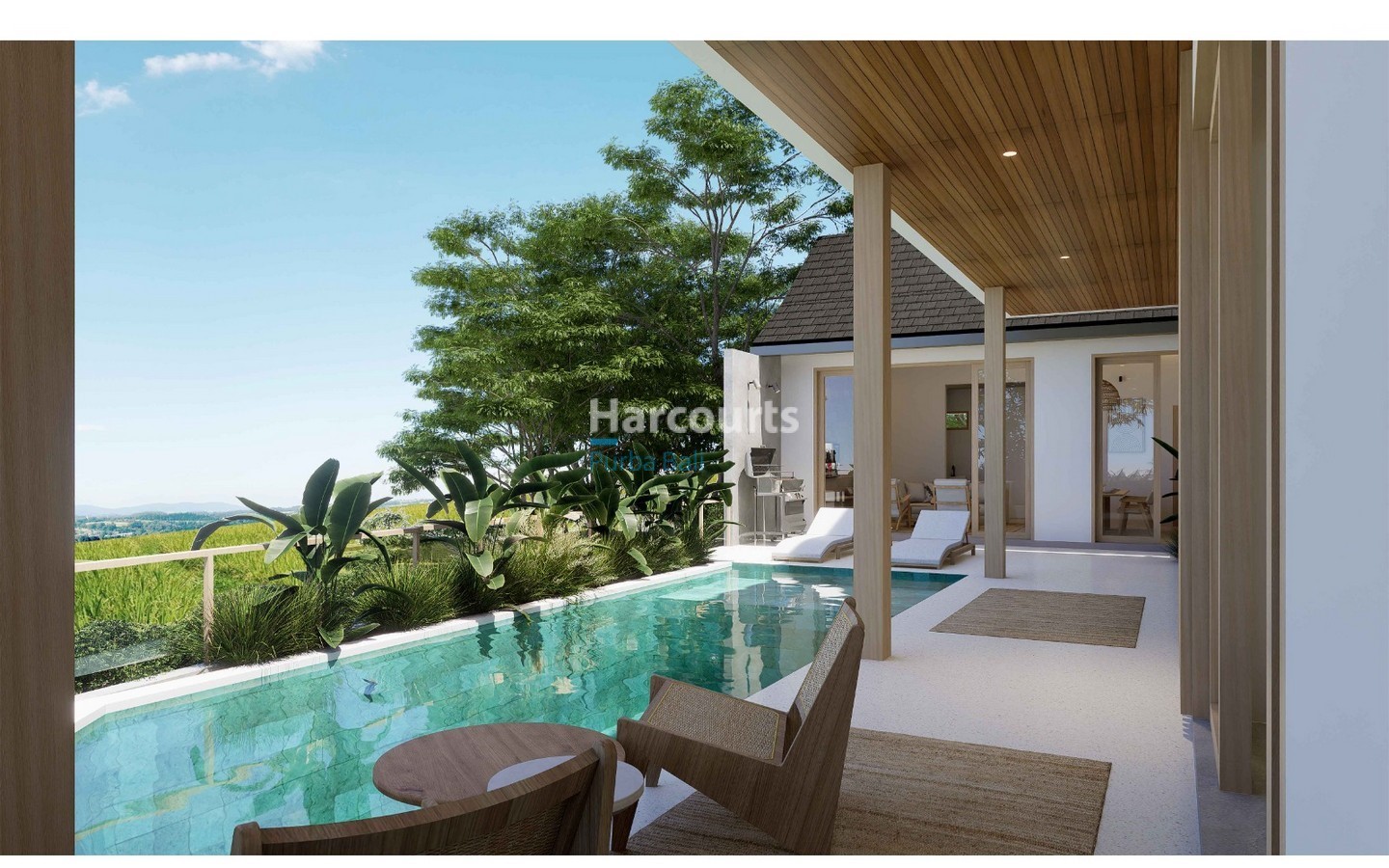

- Popular Tourist Areas: Focus on areas that attract a significant number of tourists, such as Seminyak, Ubud, Canggu, and Jimbaran. These areas tend to have higher rental demand and potential for capital appreciation.

- Infrastructure Development: Look for areas with ongoing or planned infrastructure development, such as new roads, airports, or tourism projects. These developments can significantly impact the value and appeal of the properties.

Evaluating Return on Investment (ROI)

Calculating the potential return on investment is crucial before making any investment decisions. Consider the following aspects:

- Rental Yield: Research the rental rates in the area and estimate the potential rental income. Factor in the seasonal nature of Bali’s tourism industry and any additional costs, such as property management fees.

- Capital Growth: Analyze historical price trends and consult with real estate experts to assess the potential capital appreciation over the lease term.

Engaging with Local Real Estate Agents

Collaborating with local real estate agents who specialize in leasehold properties is invaluable. They possess in-depth knowledge of the market, access to a wide range of properties, and can guide you through the buying process.

Negotiating Lease Terms

When negotiating lease terms, keep the following points in mind:

- Lease Duration: Negotiate for the longest lease duration possible within the legal limits. A longer lease term offers more stability and potential for higher returns.

- Renewal Options: Discuss renewal options and any associated costs or conditions. Having the option to extend the lease can secure your investment for the long term.

Assessing Property Condition

Conduct thorough due diligence on the property’s condition to avoid any unexpected surprises. Consider the following:

- Building Inspections: Engage qualified building inspectors to assess the property’s structural integrity, potential issues, and maintenance requirements.

- Land Certification: Verify the land certificate’s genuineness and ensure it matches the property details.

Financial Planning and Budgeting

Develop a comprehensive financial plan that covers all aspects of your investment:

- Initial Investment: Calculate the total investment required, including the property price, taxes, legal fees, and any other upfront costs.

- Ongoing Expenses: Consider recurring expenses like property maintenance, taxes, insurance, and management fees.

Calculating Additional Costs

In addition to the property’s purchase price, there are other costs to factor into your budget:

- Taxes and Fees: Be aware of the taxes, transfer fees, and government charges associated with the purchase and lease of the property.

- Legal and Professional Fees: Budget for legal fees, consultation charges, and any other professional services required during the buying process.

Balancing Risk and Reward

Every investment carries a certain level of risk. Evaluate the risk factors associated with leasehold properties and balance them against the potential rewards. Diversify your investment portfolio to spread the risk.

Taxation and Compliance

Ensure compliance with Indonesian tax regulations and understand the tax implications of your investment. Seek advice from tax professionals who specialize in cross-border investments.

Exit Strategies for Leasehold Investments

Plan for the future and consider exit strategies:

- Resale Potential: Assess the resale potential of the property and evaluate market conditions to make informed decisions in the future.

- Lease Assignment: Understand the options for assigning or transferring the lease during the lease term, should you wish to exit your investment.

Staying Updated on Market Trends

Stay informed about the latest developments and trends in Bali’s real estate market. Regularly monitor market indicators, such as property prices, rental rates, and tourism trends, to make well-informed investment decisions.

Conclusion

Bali’s leasehold market offers a lucrative opportunity for foreign buyers to capitalize on the island’s real estate boom. By understanding the unique dynamics of the leasehold market, conducting thorough research, and seeking professional advice, you can make informed investment decisions that yield attractive returns. Remember to consider factors such as location, ROI, legal considerations, and property condition. With careful planning and a long-term perspective, you can cash in on Bali’s leasehold boom and enjoy the benefits of your investment for years to come.

Frequently Asked Questions

Can foreigners buy leasehold properties in Bali?

Yes, foreigners can buy leasehold properties in Bali. The Indonesian government allows foreigners to invest in leasehold properties for residential or commercial purposes.

What is the typical lease duration for Bali’s leasehold properties?

The lease duration for Bali’s leasehold properties typically ranges from 25 to 70 years, depending on the terms agreed upon with the lessor.

How can I generate rental income from my leasehold property in Bali?

By renting out your leasehold property to tourists or long-term tenants, you can generate rental income. Engaging a reputable property management company can help you with the rental process.

Are there any restrictions on property usage for leasehold properties?

The leasehold agreement may include certain restrictions on property usage, such as limitations on commercial activities or alterations to the property. It’s important to review the lease terms carefully.

What are the risks associated with investing in Bali’s leasehold properties?

Risks associated with leasehold properties include lease expiration, changes in government regulations, and potential disputes. Conducting thorough due diligence and seeking professional advice can help mitigate these risks.

At Harcourts, our team is experienced and professional, and can help you find the perfect property and walk you step by step through the purchase process. We will be by your side to answer any questions, and facilitate all of the contracts between you and the owner.

Contact Harcourts Purba today for The Best Real Estate Experience.

Drop us a line:

Siti Salmah Purba, SH

Principle Harcourts Purba Bali

Siti : +62 878-6282-2002

Office : +62 878 6273 1018

Telephone: (0361) 9091299

Email: [email protected]

Or Visit Our Offices:

Address: Jl. Pemelisan Agung No.22,

Tibubeneng, Kec. Kuta Utara,

Kabupaten Badung, Bali 80351

Harcourts Purba Bali today for the Best Real Estate Experience!