Berawa | 35y Lease: The Ultimate Rental Yield Investment

- IDR

- USD

- AUD

- EUR

Overview

- 1. Villa

- 132

- 2

- 1

- 255

- 2023

Description

The Investment Angle

This is a high-liquidity asset located in Berawa’s “Golden Triangle.” Unlike generic luxury villas, this property is engineered for the short-term rental market, where proximity to infrastructure and thriving tourist scene drive occupancy rates and nightly premiums.

Long term rental yield: 8% (proven)

Short term rental yield: 10-13% (estimated)

Asset Specification & Revenue Drivers

-

Yield-Optimized Design: The open-concept, high-ceiling architecture isn’t just aesthetic; it maximizes the “spaciousness” factor that drives higher rankings on booking algorithms.

-

Dual-Master Configuration: Two equally sized master suites with private en-suites allow for “split-stay” bookings or high-end co-living, a massive trend among Bali’s digital nomad elite.

-

Monetizable Outdoor Space: The integrated pool-side bar and lounge area transform the garden into a functional entertainment hub, a key requirement for achieving premium pricing.

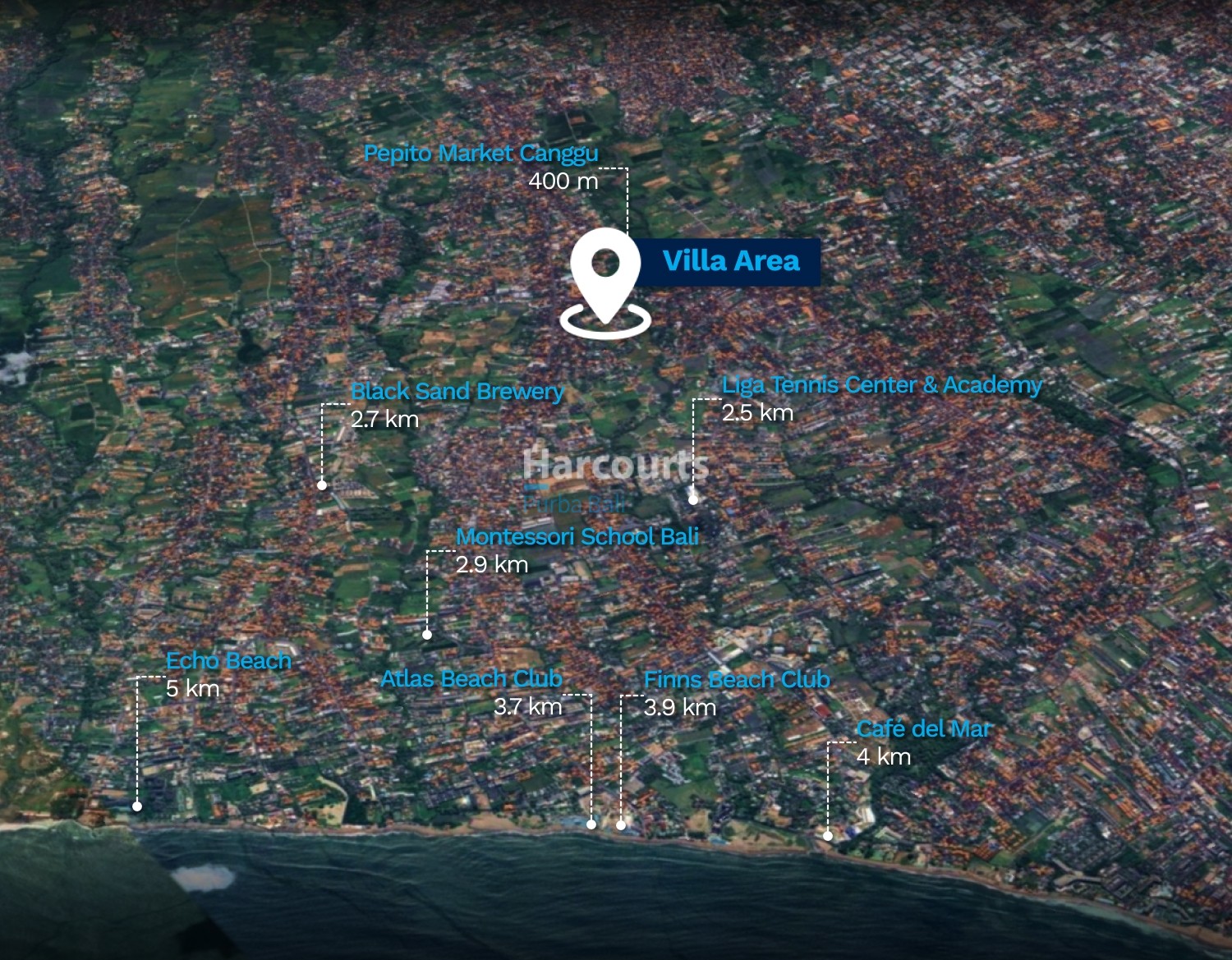

Market Dynamics: Why Berawa?

Berawa has transitioned from an emerging neighborhood to Bali’s primary destination for high-net-worth travelers and long-term expats:

-

Beach: Located within minutes of Berawa Beach, the villa captures the surf-tourism demographic, ensuring high occupancy during peak swell seasons.

-

Lifestyle: Surrounded by the island’s most established beach clubs (Finns, Atlas) and Michelin-standard dining, the property benefits from a massive, built-in demand for nearby accommodation.

-

Dual-Market Resilience: The proximity to international schools and premium athletic facilities (Liga.Tennis, Wanderlust Crossfit) provides a “safety net” pivot into the stable, high-value long-term family rental market.

-

High Exit Liquidity: As Berawa reaches full development, turnkey properties with modern specs are seeing significant capital appreciation and remain the most liquid assets for secondary sales.

The Bottom Line

This villa represents a strategic entry into Bali’s most resilient micro-market of Berawa/Canggu. For the discerning investor, it offers a rare combination of immediate cash flow potential and long-term capital security in a world-class destination.

Address

Open on Google Maps- Area Canggu

- Island Bali

- Location Berawa

- Country Indonesia

Details

Updated on February 4, 2026 at 12:42 pm- Property ID: HPC3958

- Price: 35 years Rp. 5,000,000,000

- Land Area: 255 m²

- Garage: 1

- Garage Size: 24 m2 + storage space

- Year Built: 2023

- Property Type: 1. Villa

- Property Status: 2. For Leasehold / Hak Sewa

- Bedrooms: 2

- Bathrooms: 2

- Building Style: Modern, Contemporary

- Building Status: New home

- Location Preference: Walk to restaurants

- Furniture: Fully Furnished

- Pool Details: Pool Deck, Pool Bar, Shape - Rectangular

- Water Supply: Town Supply/PDAM

- Property Title: Leasehold

- Land Feature: Level Land

- Pool Size: 75

Contact Information

View Listings- Harcourts Purba Bali (AC)

- +62 878 3848 0460WhatsApp

![Canggu - Berawa [Satellite] Canggu – Berawa [satellite]](https://harcourtspurbabali.com/wp-content/uploads/2023/04/Canggu-Berawa-Satellite-3-1170x785.jpg)

![Canggu - Berawa [Satellite] Canggu – Berawa [satellite]](https://harcourtspurbabali.com/wp-content/uploads/2023/04/Canggu-Berawa-Satellite-3.jpg)